In banking, “simple” API requests rarely stay simple. A new product team asked for “just an API” to balances, limits, and KYC status. Weeks turned into months as point-to-point mappings multiplied. Each consumer needed a slightly different shape or timing; each change risked breaking another team. Release notes filled with “temporary” adapters that became permanent. By the third sprint, engineers spent more time reconciling schemas and retries than building features. The request was simple; the data model wasn’t—because the truth lived in multiple systems, updated on different schedules.

Once we treated data as a product, integration stopped being a project.

Background & Challenges

A retail-led bank set out to modernize how customer, account, and transaction data flows across mobile, web, branch, payments, risk, and analytics. The goal: a single, real-time foundation to power precision marketing and customer-facing experiences without piling more load on core systems.

But reality pushed back:

-

Fragmented sources & “data islands.” Core banking, lending, channel integration, payments, and CRM all moved at different cadences and spoke different dialects.

-

Strict network segmentation. Multiple network zones with hard isolation made cross-environment capture and movement difficult.

-

Security, compliance, and DR. Banking-grade encryption, auditability, and metro-area disaster recovery (RPO=0, RTO < 30 minutes) were non-negotiable.

-

Operational complexity. Many moving parts meant high configuration risk; troubleshooting was slow without end-to-end observability.

Accuracy across heterogeneous systems and strong stability were non-negotiable.

The TapData Solution

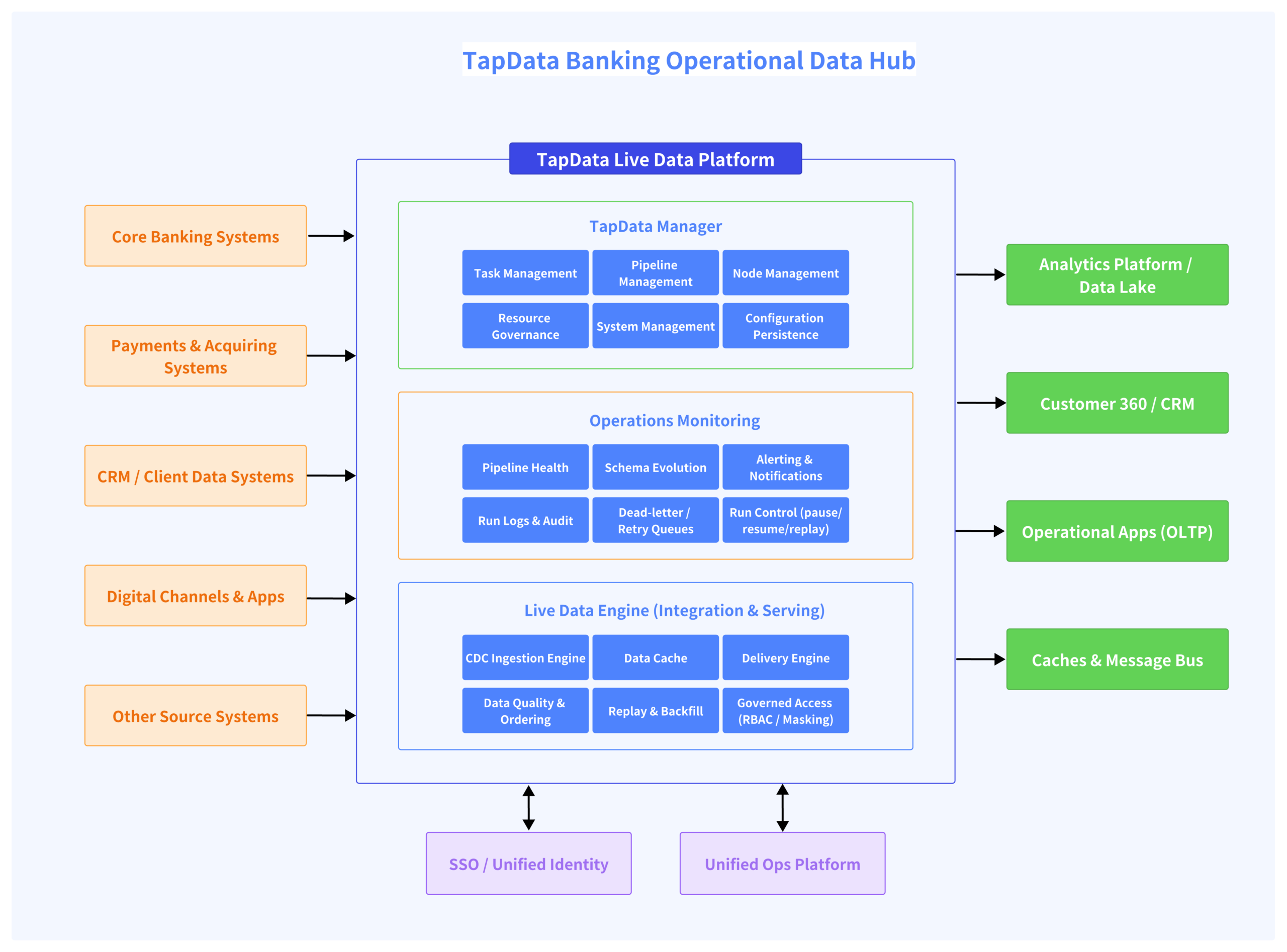

The bank implemented TapData Live Data Platform as a centralized Operational Data Hub (ODH) and delivered it as Data-as-a-Service (DaaS) to every team and channel.

Unified, log-based CDC ingestion

TapData captures database changes from core banking and lending (e.g., Oracle/DB2), channel and payment platforms, and CRM—log-based, low-overhead, and resumable. Ordering and replay guarantee correctness; catch-up automatically clears any backlog after maintenance windows.

Domain & master modeling

A shared contract organizes Customers, Accounts, Transactions, Limits, Products and more. Schema evolution and model versioning let teams change upstream systems without breaking consumers.

Incremental materialized views for speed

Domain-scoped incremental materialized views keep key datasets (e.g., Customers, Accounts, Transactions, Limits) current at seconds-to-minutes freshness. They support multiple consumption paths without increasing read pressure on the core:

-

Application reads via denormalized, query-ready tables or cache layers

-

Downstream analytics targets for investigative and near-real-time reporting

-

Versioned REST APIs for product teams, with RBAC and field-level masking applied at publish time

This pattern replaces ad-hoc point-to-point jobs with governed, model-backed services that teams can reuse across channels.

Cross-environment, secure by design

TapData’s link isolation and policy controls allowed safe data flow across segmented networks. End-to-end encryption, access control, and operational audit trails aligned with bank-grade security standards. Four-level monitoring and lineage delivered full traceability from source to consumer, with proactive alerts for drift or lag.

Resilience & DR

A distributed, highly available deployment enabled same-city DR. In production the platform achieved RPO = 0 and RTO < 30 minutes, while keeping key links at seconds-level latency—meeting continuity targets without overburdening the core.

Fast to build, easy to run

Visual/no-code configuration and remote deployment features simplified agent rollout and reduced custom code. Fine-grained permissions minimized access to regulated systems. Full-pipeline observability made anomalies easy to trace, improving SRE efficiency.

We reduced custom code and accelerated releases—without putting extra read pressure on the core.

Outcomes

-

One real-time view across channels. Customer and account states stayed consistent everywhere—improving service quality and reducing manual reconciliations.

-

Seconds-level freshness at scale. High-frequency increments and large historical loads completed efficiently; steady-state pipelines kept seconds-to-minutes freshness while offloading read pressure from core systems.

-

Resilience you can trust. RPO = 0 / RTO < 30 min with same-city DR, plus orderly rollback/replay when needed.

-

Faster delivery, lower effort. No-/low-code pipelines, remote deployment, and standardized APIs shortened integration lead time and cut bespoke development. Teams could reuse models instead of rebuilding point-to-point jobs.

-

Governed access and audit-friendly reporting. Field-level masking, RBAC, lineage, and full audit trails supported supervisory reporting and internal controls.

“With TapData we moved from fragmented feeds to model-once, reuse-everywhere. Data didn’t just sync; it became a product our teams could trust and build on.”

Where TapData Shows Up in the Bank’s Day-to-Day

-

Customer 360 for frontlines: Instant balances, limits, and risk context visible at the counter or in the app—no screen-hopping or stale snapshots.

-

Risk & compliance: Fresh transactions stream to AML and fraud detection while protected by masking and access policies.

-

Analytics without the drag: Analysts query recent history in OLAP without hitting the core, while apps use API contracts that remain stable through change.

Real-time stopped being a project and became the default—one model, one hub, governed APIs, the same truth everywhere.